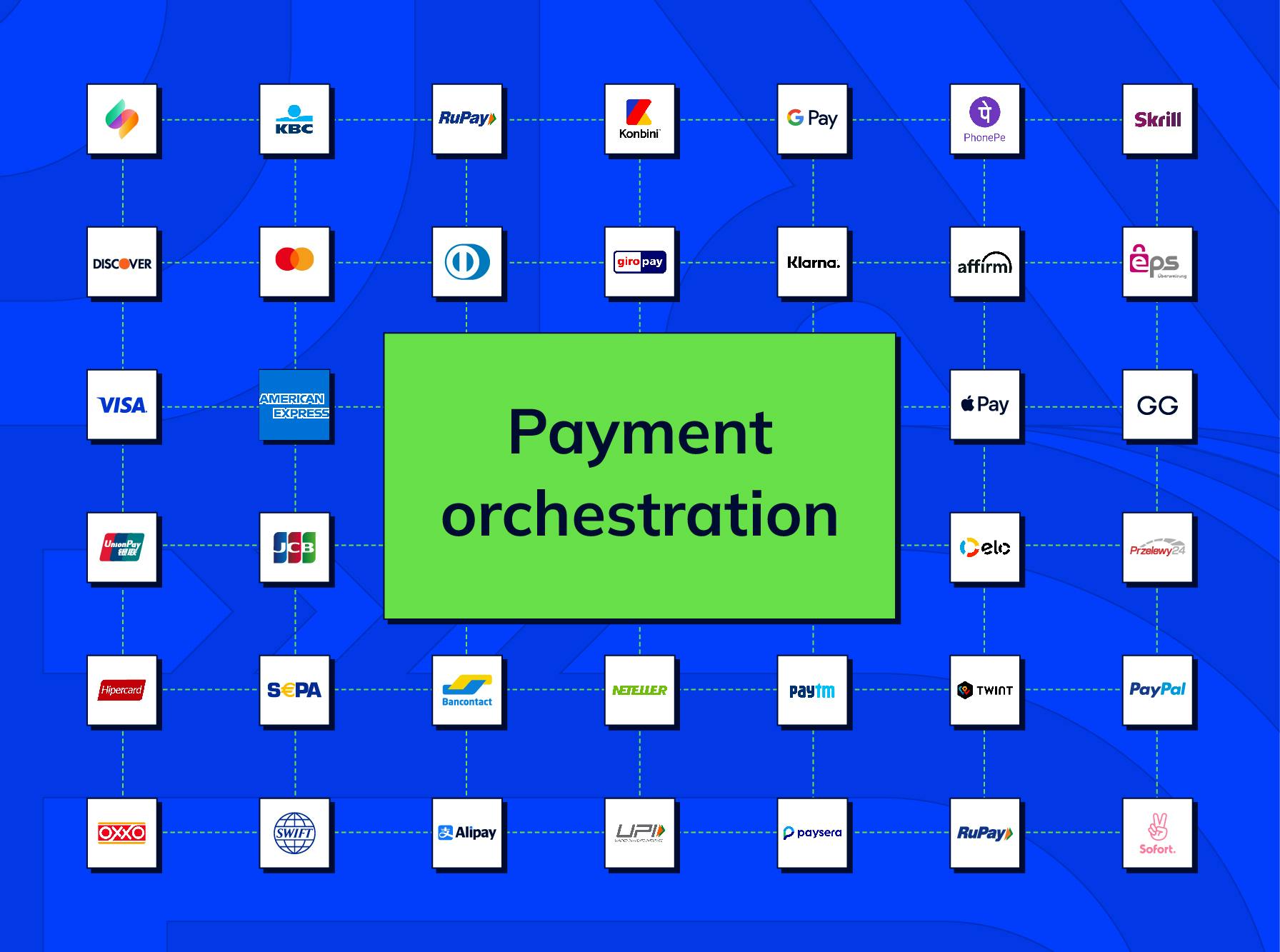

Implementing a payment orchestration platform requires a strategic approach to ensure seamless integration, optimal transaction routing, and compliance with security regulations. Businesses have two primary options for implementation: developing an in-house solution or outsourcing to a third-party payment orchestration provider. Each approach has its own advantages and challenges, depending on the company’s resources, expertise, and long-term goals.

Below, we compare these two methods in detail.

In-house development

Building a payment orchestration platform internally gives businesses complete control over their financial infrastructure. This approach is often favored by enterprises with extensive development teams and specific customization needs.

Advantages of in-house development

Businesses can design their payment orchestration system to meet specific needs, ensuring complete alignment with internal workflows and business objectives.

- Direct integration with internal systems

In-house development allows for seamless integration with proprietary systems such as ERP, CRM, and fraud detection tools.

Challenges of in-house development

- High development and maintenance costs

Creating and maintaining a payment orchestration system requires significant investment in infrastructure, skilled developers, and ongoing maintenance.

- Complex compliance requirements

Companies must ensure their system meets international security standards (PCI DSS, PSD2, etc.), which can be resource-intensive.

Outsourcing to a Payment Orchestration Provider

Outsourcing payment orchestration involves partnering with a third-party provider that offers a ready-made platform with built-in integrations, automation, and security compliance. This option is ideal for businesses looking for a fast and cost-effective solution.

Advantages of Outsourcing

Businesses can integrate a third-party payment orchestration platform within weeks, rather than months, significantly reducing time to market.

Instead of investing in development, companies pay for a service that includes maintenance, updates, and compliance management.

- Access to advanced features

Third-party providers offer pre-integrated payment gateways, fraud detection tools, and dynamic routing, reducing the need for manual intervention.

Challenges of outsourcing

While third-party platforms offer flexible features, they may not provide the same level of customization as an in-house solution.

- Dependency on external providers

Businesses rely on the provider’s infrastructure, which means potential risks in case of downtime or service limitations.

Most Popular Payment Methods in the World: Analysis by Markets

Most Popular Payment Methods in the World: Analysis by Markets How to Increase Conversions in an Online Store with a Checkout Page

How to Increase Conversions in an Online Store with a Checkout Page How Tranzzo Simplified the Payment Process for Tickets.ua

How Tranzzo Simplified the Payment Process for Tickets.ua Integrating Multiple Payment Methods: Challenges and Solutions

Integrating Multiple Payment Methods: Challenges and Solutions Abandoned Shopping Carts: Why Businesses Lose Revenue and How to Increase the Number of Successful Payments

Abandoned Shopping Carts: Why Businesses Lose Revenue and How to Increase the Number of Successful Payments